2021 colorado ev tax credit

Colorado Electric Vehicle Tax Credit. Colorados tax credits for EV purchases.

Tax Credits Drive Electric Northern Colorado

DR 0158-I - Extension of Time for Filing Colorado Individual Income Tax.

. Please visit TaxColoradogov prior to completing this form to review. Electric-Vehicle Tax Credit Colorado EV Infrastructure. DR 0104US - Consumer Use Tax Reporting Schedule.

112020 112021 112026 Classification Gross Vehicle Weight Rating GVWR Light duty passenger vehicle NA 2500 2000 1500. You may use the Departments free e-file service Revenue Online to file your state income tax. The most recent application period for Colorado EV incentives ended June 11 2021.

To make the plan work the states largest power company has also tailored the new. You do not need to login to Revenue Online to File a Return. Tax Year 2021 Instructions DR 0617 071321 COLORADO DEPARTMENT OF REVENUE DONOTSEND TaxColoradogov Use this form to calculate the innovative motor vehicle and innovative truck credit available for the purchase lease or conversion of a qualifying motor vehicle.

Medium duty electric truck. Heavy duty electric truck. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

Contact the Colorado Department of Revenue at 3032387378. Innovative Motor Vehicle Credit. The credits which began phasing out in January will expire.

Light duty electric truck. 25 up to 6000 Clean fuel refrigerated trailer. If you purchase a new electric vehicle from 2021-2023 you can get a 2500 tax credit.

Feel good about driving a car that is friendlier to the environment than your old car. You can charge at home. If you purchase a new electric vehicle by the end of 2020 you can get a 4000 tax credit.

2500 for purchase or conversion. At first glance this credit may sound like a simple flat rate but that is unfortunately not the case. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

The current iteration offering up to 5000 in tax credits dropped to 4000 in January and will be reduced again to 2500 next year. Updated March 2022. Xcel Energy has a new suite of programs to supercharge Colorados switch to electric vehicles.

The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. After you file you have the option of setting up a Login ID and Password to view your income tax account in Revenue Online. 2500 tax incentive on ALL new EVs in Colorado in addition to the Federal tax credit available on many models.

Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted. Save time and file online. The credit is worth up to 5000 for passenger vehicles and more for trucks.

If you lease an electric vehicle for two years beginning before the end of 2020 you can get a 2500 tax credit. Tax credits jump to 900 for e-bikes 7500 for electric motorcycles in Build Back Better Act. Federal Tax Credit Depends on the Manufacturer up to 7500 Coming to Town June 2nd 2021.

The tax credit for most innovative fuel. Electric bicycles and electric motorcycles may. DR 0204 - Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Individual Estimated Tax.

Last year the state legislature extended the income tax credits through the end of 2025 offering 2000 a year between 2023 to 2025. 1125 up to 7500 Hydraulic hybrid trailer. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla.

Please use the link below to download 2021-colorado-form-dr-0617pdf and you can print it directly from your computer. Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. 112017 112020 112021 but prior to.

25 up to 6000 Aerodynamic technologies. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. Credit Amounts for Leases of Qualifying Electric and Plug-in Hybrid Electric Vehicles and Trucks Tax year beginning on or after.

DR 0104X - Amended Individual Income Tax Return. No more standing in the wind or snow waiting at the gas pump. For additional information consult a dealership or this Legislative Council Staff Issue Brief.

So weve got 5500 off a new EV purchase or lease and 3000 off of used. Beginning on January 1 2021. 20th 2021 812 am PT.

Complete Part 1 with the vehicle or trailer information for Drive Clean Rebates for Electric Cars Purchased on or Before June 30 2021 The Drive Clean Rebate amount depends on the EPA all-electric range for that car model. Light duty passenger vehicle. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours.

375 up to 7500 Conversion to a clean fuel refrigerated trailer. DR 0104TN - Colorado Earned Income Tax Credit for ITIN Filers. Top 5 Reasons to Drive an EV in Colorado.

Examples of electric vehicles include. Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche. Tax credits are as follows for vehicles purchased between 2021 and 2026.

Qualifying vehicle types include electric vehicles plugin hybrid electric vehicles liquefied petroleum gas LPG vehicles and compressed natural gas CNG vehicles. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market.

DONOTSEND DR 0617 071321 COLORADO DEPARTMENT OF REVENUE TaxColoradogov Innovative Motor Vehicle Credit and Innovative Truck Credit Tax Year 2021 Instructions Use this form to.

Electric Vehicle License Plate Bill Passes

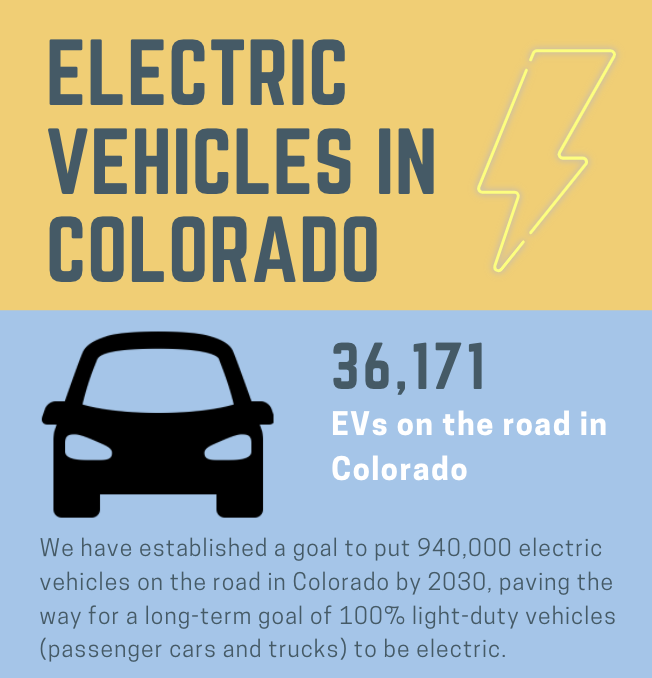

Electric Vehicles In Colorado Report May 2021

How Do Electric Car Tax Credits Work Credit Karma

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow

Ev Tax Credit Calculator Forbes Wheels

Tax Credits City Of Fort Collins

Zero Emission Vehicle Tax Credits Colorado Energy Office

How To Claim An Electric Vehicle Tax Credit Enel X

Eligible Vehicles For Tax Credit Drive Electric Northern Colorado

Electric Vehicle Tax Credits What You Need To Know Edmunds

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Rebates And Tax Credits For Electric Vehicle Charging Stations

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

/https://www.forbes.com/wheels/wp-content/uploads/2021/10/TopEVResistanceReasons.png)

Survey 23 Of Americans Would Consider Ev As Next Car Forbes Wheels

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow